博客:全球废钢的未来供应预期

去年的这个时候,我写了一篇博客文章,论述了废钢供应不断增长很有可能改变未来的炼钢工艺。在本篇博客中,我进一步阐述全球废钢供应的预期增长态势。

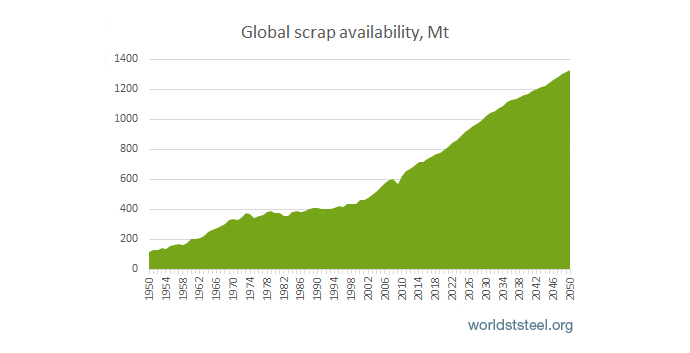

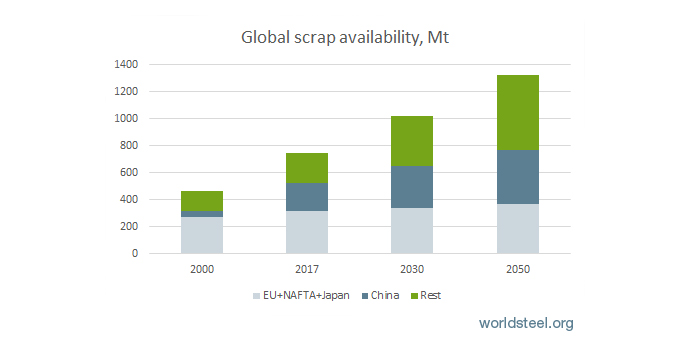

据世界钢铁协会估计,2017年全球废钢供应量约为7.5亿吨,其中6.3亿吨由全球钢铁和铸造行业进行回收利用。 世界钢铁协会预计到2030年全球废钢供应量将达到10亿吨左右,到2050年将达到13亿吨。换言之,预计未来30年,作为主要炼钢材料之一的废钢将增长超过5亿吨。

谁将引领此轮增长势态?

预计发展中国家,尤其是中国,废钢供应量将呈现最强劲增长态势,由此可见,二十世纪九十年代和二十一世纪初中国钢铁消费量增长惊人。估计到2030年中国的废钢供应量将由如今的2亿吨增长至3亿吨左右,到2050年将增至约4亿吨。

目前,中国电炉炼钢(EAF)的所占比例相对较低,与电炉和转炉(BOF)炼钢技术发达的地区相比,中国的废钢使用量相对较少,但这可能随着废钢供应的增加而改变。了解更多详情,请登录世界钢铁协会钢铁博客页面:发展电炉炼钢,时机成熟了吗?

中国炼钢产能结构已经发生了一些重大变化,关闭了约1.4亿吨的中频炉产能,新的环保措施的推行也控制产量的增长。新电炉炼钢厂(约5000万吨)预计将在未来5年投入使用。

在其他发展中地区,如印度和东盟,钢铁产量和消费量的持续强劲增长也将有助于废钢供应的增长。 预计未来15年内印度和东盟地区的废钢供应量将翻一番。

世界其他地区的废钢供应情况如何?

世界其他地区的废钢供应预计也会有所增长,尽管速度要比世界发展中地区慢得多。 据估计,北美自由贸易区、欧盟以及日本这几个发达区域及国家,目前的废钢供应约达3.2亿吨,预计到2030年将达到约3.5亿吨。

上述供应预期将意味着什么?

废钢供应的强劲增长表明,从中长期来看,预计钢铁行业将越来越多地用废钢取代自然资源,从而节约原料,能源以及减少二氧化碳排放。