气候变化与钢铁生产

钢铁在生活中无处不在,它是未来社会可持续发展的基石。

无论是未来能源和交通系统的发展,自然灾害的预防措施,适应气候变化的基础设施、建筑和住宅,还是低碳制造业和农业,钢铁都是解决之道的核心要素。

循环经济的发展正不断延长钢材的使用寿命。钢铁可以完美地再制造、再利用和无限循环,是循环经济不可或缺的一环。

钢铁生产的转型

铁是通过去除铁矿石中的氧和其他杂质生产出来的。当铁与碳、回收废钢以及少量其他元素结合时,就变成了钢。一旦生产出来,钢铁就成为一种永久性资源:钢铁可以百分百无限期循环利用,而且不会影响任何材料特性。

钢铁行业属于真正的全球性产业,原材料(例如铁矿石和废钢)和钢铁产品的全球贸易规模庞大。今天,全球70%以上的钢铁生产集中在亚洲。

钢铁行业仍属于一个碳排放和能源消耗密集型行业。尽管如此,钢铁行业正致力于不断降低其生产经营和产品使用的碳足迹。

钢铁行业全力支持《巴黎协定》设定的气候目标。

《巴黎协定》

《巴黎协定》于2015年通过。协定的核心目标是确保与工业化之前水平相比,全球温升幅度显著低于2摄氏度,并且努力将温升幅度限制在1.5摄氏度以内。协定旨在本世界下半叶,实现人类活动的温室气体排放与自然吸收之间的平衡。

然而并没有单一的解决方案可以大幅降低钢铁行业的碳排放,推动行业和社会转型的主要要素包括:

虽然每一项要素都将在温室气体减排方面发挥重要作用,但本文件重点关注第一项要素—减少钢铁生产过程中的排放量。

承担责任-减少钢铁行业自身影响

- 2020年,平均每生产1吨钢排放1.89 吨二氧化碳。2020年,全球共生产18.6亿吨钢,钢铁行业的直接碳排放总量约为26亿吨,占全球人类活动碳排放总量的7%至9%。

- 2020年,国际能源署发布了一份路线图3,旨在探索钢铁生产所需的潜在技术和战略,寻求一条符合国际能源署宏伟愿景的道路,从而提高能源行业的可持续发展能力。

国际能源署钢铁技术路线图

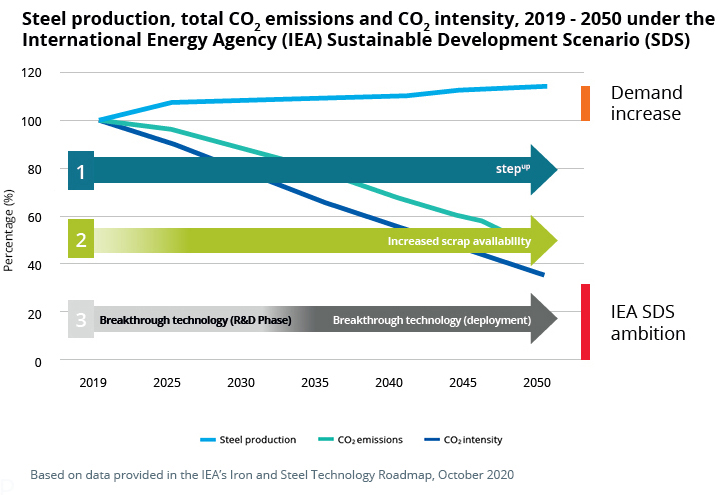

2020年10月,国际能源署发布了钢铁技术路线图。该文件分析了不同减排技术选择所带来的影响和利弊,以及针对本行业制定的、符合《巴黎协定》的政策目标。

在国际能源署的可持续发展情景下。2050年钢铁行业直接排放总量比2019年降低50%以上。按照相同的路径,粗钢生产的排放强度必须降低58%。

国际能源署认为钢铁对现代经济至关重要,但指出,在支撑钢铁需求量预期增长的同时减少排放,这将带来巨大挑战。虽然提高材料使用效率的措施有助于行业的减排,钢铁行业仍需进一步开发和部署一系列突破性技术方案和配套的基础设施,以实现长期、深度减排。

另外,国际能源署还指出,各国政府必须发挥关键性作用,确保本行业的可持续转型。最后,国际能源署呼吁各国政府、钢铁行业、科研机构和非政府组织群体以及其他利益相关方采取行动。

减少环境影响的三个环节:能效升级、充分利用废钢以及开发突破性减排技术:

技术组合

低碳炼钢没有单一的解决方案,需要多种技术的组合,可以单独部署,也可以根据当地的情况组合部署。钢铁行业在全球范围内开展了大量研究、开发及部署工作,探索各种解决方案。

无论在任何地方,突破性技术方案的部署均取决于可利用的资源及地方政策的支持。

举例:

- 在低碳能源丰富的地区,人们可能期望部署水电解和氢还原技术。

- 在二氧化碳存储技术获取方便的地区,例如,阿联酋、美国或荷兰等地,最佳选择可能是CCS技术或蓝氢还原技术。

- 在生物质资源获取方便的地区,例如,澳大利亚或巴西等地,可以使用可持续的生物质和生物炭替代现有炼钢工艺中使用的煤炭。

- 碳捕获和利用技术(CCU)利用可再生能源与富含碳的废气相结合,生成合成燃料以及可用作化工原料的丙酮、异丙醇等化学物质。

什么是低碳钢?

世界钢铁协会对低碳钢的定义为通过利用科学技术和实践经验生产,相比传统生产方式二氧化碳排放量显著降低的钢材。

国际能源署的路线图预计,突破性技术的大范围应用,将在2030至2050年期间加速。不过,从2025年左右开始,我们将看到先驱企业率先尝试和实施一些项目,用于增加市场上低碳钢的供应数量。等到本世纪中叶,从这些创新项目中获得的经验教训将会为全行业范围的推广应用提供支持。

成本影响

每家企业选择投资哪种突破性技术,将在很大程度上取决于可利用的资源和现有的政策支持。然而,即使投资条件再好,毫无疑问的是低碳钢的生产成本将大大高于目前生产的钢材。

生产成本增加的原因包含以下因素:

- 运营支出增加:需要使用绿氢或低碳电等更加昂贵的低碳资源;CCS设备的运行和存储二氧化碳需要增加额外能源

- 资本支出增加:需要使用氢基DRI设备替代碳基高炉设备,使用电炉设备替代转炉设备;将现有设备替换成使用氢或其他燃料的设备;需要改造CCS或CCUS基础设施

- 资本损失:原本可以长期使用的钢铁生产设备可能需要提前退役或销账

国际能源署估计,与目前成本相比,生产成本的上升幅度将在10%至50%之间,成本增幅显著超出生产毛利率。尽管如此,钢铁行业将继续通过提高运营效率和推广智能化制造技术来削减成本,部分抵消新增成本。

钢铁行业的转型是一个长期渐进的过程,部分企业、国家、地区的推进速度大大超前,因此在一段时期内,在同一个市场上,采用低碳技术生产的钢与采用传统技术生产的钢材(以及其他材料)将形成竞争。这将给先驱企业造成不利影响,因此需要政策扶持。

政府与钢铁业之间的合作是未来可持续发展的基础

政府可利用的手段、钢铁行业的特点、以及低碳技术的经济适用性和获取便利性,各个国家和地区之间有所不同。有了《巴黎协定》,我们相信各国完全能够评估和实施符合各国特定情况的政策和技术策略。

尽管如此,为了克服相关技术和经济的挑战,为钢铁行业向低碳炼钢的转型创造必要的市场条件,各 国政府、钢铁行业以及其他利益相关方都需要密切协作。

在实践中,这意味着:

钢铁行业将要:

减少行业自身排放量

- 在全球行业范围内,加快提高能源效率和碳效率,与合作伙伴和相关行业展开合作并形成合力

- 通过提高研发能力,开发一系列突破性技术组合

- 通过技术开发,充分利用所有回收废钢的价值,确保所有已回收的废钢循环再利用为新的钢铁产品

建立伙伴关系,推进转型

- 与政府部门合作,明确突破性技术的大规模应用所需的低碳资源和融资

保持透明

- 继续测算和公布钢铁行业的碳排放情况

各国政府需要提供扶持性和推进性的框架体系:

- 政府不应对任何可利用的技术产生偏向,应当对不同技术的使用给予认可

- 通过提高低碳材料的需求量,以及创建低碳钢市场,减轻先驱企业所面临的不利因素,需要注意的是,目前低碳钢的生产成本比传统钢材高50% 。与此同时,相关政策应该确保企业的主动行为有所回报,不能让投资高效炼钢技术的企业在市场上初于不利地位

- 方便企业获得过渡融资,比如通过可持续性融资框架

- 确保低碳资源的可利用性和经济适用性,包括一定数量的CCS基础设施和氢等

- 采用生命周期评价方法,支持循环经济,包括对产品使用寿命终点阶段的废钢进行收集和清理

- 采取创新型手段管理低碳工艺和低碳产品,如利用CCU工艺生产的产品

利益相关方和钢铁下游用户也能发挥一定作用,他们应当:

- 形成低碳钢需求,并认识到低碳钢产生的额外成本

- 考虑产品的全生命周期,产品设计中应考虑适用于再制造、再利用和再循环的产品